maricopa county tax lien foreclosure process

Send a completed order form with your payment of 2500 personal or business check cashiers check or money order to. The above parcel will be sold at Public Auction on.

Delinquent Property Tax Lien Sale Overview Arizona School Of Real Estate And Business

Securing a tax lien against real estate for which the taxes remain unpaid is a high priority for investors.

. The Tax Lien Sale of unpaid 2020 real property taxes will be held on and closed on Tuesday February 8 2022. All groups and messages. Baumann Doyle Paytas Bernstein PLLC.

For additional information on Tax Deeded Land Sales you may contact the Treasurers Office at. Interested in a tax lien in Maricopa County AZ. Every year the counties have auctions to sell these unpaid property tax liens.

Maricopa County AZ currently has 18175 tax liens available as of June 3. For more assistance with your research please speak with an Information or Reference Services staff member. Only 1 2 of tax liens sold result in the bidder acquiring the property.

Call the Mohave County Treasurer at 928 7530737 or 800 420- 6352 and ask whether the - property owner is in bankruptcy. Maricopa County CA tax liens available in CA. Shop around and act fast on a new real estate investment in your area.

At least 30 days before filing for foreclosure complaint you must send notification to the following addresses of your intent to foreclose. Offers a full range of legal services concerning tax lien foreclosure actions. The property owner of records of the Mohave County Recorder according to the county recorders records OR.

Flood Control District of Maricopa County. These listings may be used as a general starting point for your research. All groups and messages.

The Tax Lien Sale provides for the payment of delinquent property taxes by an investor. If you do not have access to a computer the Treasurers Office will provide public access computers by. Questions and Research Requests Office Hours 8am - 5pm Monday - Friday except Federal Holidays Customer Service Phone.

Delinquent and Unsold Parcels. Find the best deals on the market in Maricopa County CA and buy a property up to 50 percent below market value. HUD VA and Tax Sales AZ Tax Lien Foreclosure Feb 16 2020 1647.

TAX LIEN SALES Below is a partial listing of materials available on this topic in the Superior Court Law Library. Now what May 7 2021 1125. What is the tax deed process.

A cashiers check in the amount of 15500000 made out to Flood Control District of Maricopa County is required to be an eligible bidder. People buy tax liens for two reasons. Directing the Maricopa County Arizona Treasurer to execute and deliver to the purchaser of the Maricopa County Arizona tax lien certificate in whose favor the judgment is entered including the state a deed conveying the property described in the Maricopa County Arizona tax lien certificate Sec.

As of October 2 Maricopa County AZ shows 1469 tax liens. Any certificate holder including the County may file an Action to Foreclose in the Superior Court of Maricopa County three years from the date of the sale. Ad HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings.

When a Maricopa County AZ tax lien is issued for unpaid past due balances Maricopa County AZ creates a tax-lien certificate that includes the amount. Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More. Arizona statute requires that a Notice of Intent be sent out at least 30 days and no more than 180 days before a Complaint is filed attempting to foreclose the tax liens.

The Treasurers tax lien auction web site will be available 1252022 for both research and registration. Obtaining Ownership Statistically most tax liens are redeemed by the owner. 2a The property owner according to the records of the Mohave County Assessor and.

Notice of Intent to Foreclose. Find the best deals on the market in Maricopa County County AZ and buy a property up to 50 percent below market value. Arizona Revised Statutes Title 42 - Taxation Chapter 18.

These buyers bid for an interest rate on the taxes owed and the right to collect. Maricopa County AZ Tax Liens and Foreclosure Homes. The County may have only provided you a summary and that is fine too.

Maricopa County County AZ tax liens available in AZ. On a CD from the Research Material Buying Guide available at the beginning of January. First to obtain ownership of a property through foreclosing the lien.

Because of this in addition to the rate of return being between 16 and 18 percent interest. HUD VA and Tax Sales AZ Tax Lien Foreclosure Feb 16 2020 1647. For example Maricopa County conducts its on-line auction in February of each.

Buying Selling Real Estate Discussion Found a property with a tax lien against it. SELECTED LAWS REGULATIONS AND ORDINANCES. 602-506-8511 or the Clerk of the Boards Office at.

Durango St Phoenix Arizona 85009. Or second to obtain a high rate of interest on the amount invested. General Foreclosure.

Maricopa County will not be held responsible for legal or court fees when the judicial foreclosure process is stopped due to redemption payments made in an untimely manner. Monday June 20 2022 at 1100 am. All requests regarding tax liens such as requests for assignments sub-taxing reassignments merge vacate and Treasurers deeds should be sent to Maricopa County 301 W.

How does a tax lien sale work. The notice is required to be sent to the the situs address of the property each of the owners of record and the county treasurer via. Also any information you have regarding the property including parcel number and address and any information you have on the debtor would be helpful too.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Maricopa County AZ at tax lien auctions or online distressed asset sales. Shop around and act fast on a new real estate investment in your area. 2022 Tax Sale Details.

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

The Statutory Requirements For Purchasing Redeeming And Foreclosing On Tax Liens In Arizona Provident Lawyers

Bonds Overrides Property Tax Calculator

Maricopa County Treasurer S Office John M Allen Treasurer

Tax Liens Tax Lien Foreclosures Arizona School Of Real Estate And Business

List Of Excess Funds You May Be Entitled To If You Had A Foreclosure Integrity All Star Real Estate Team Berkshire Hathaway Homeservices Arizona Properties

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

Tentative 4 46b Maricopa County Budget Includes Property Tax Rate Reduction Ktar Com

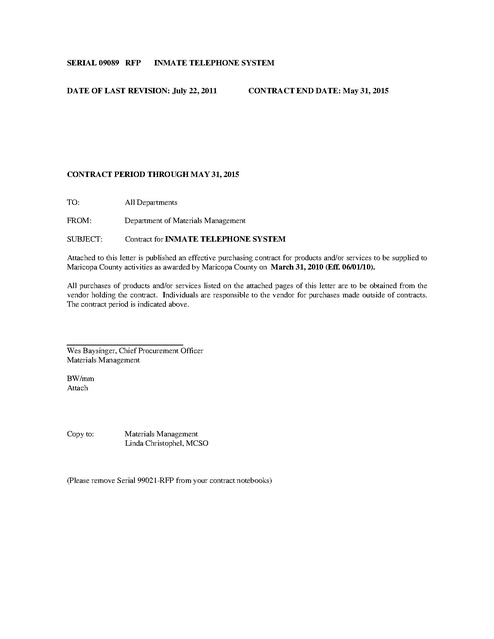

Az Maricopa County Contract With Vac Through 5 31 15 Prison Phone Justice

Maricopa County Assessor S Office

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

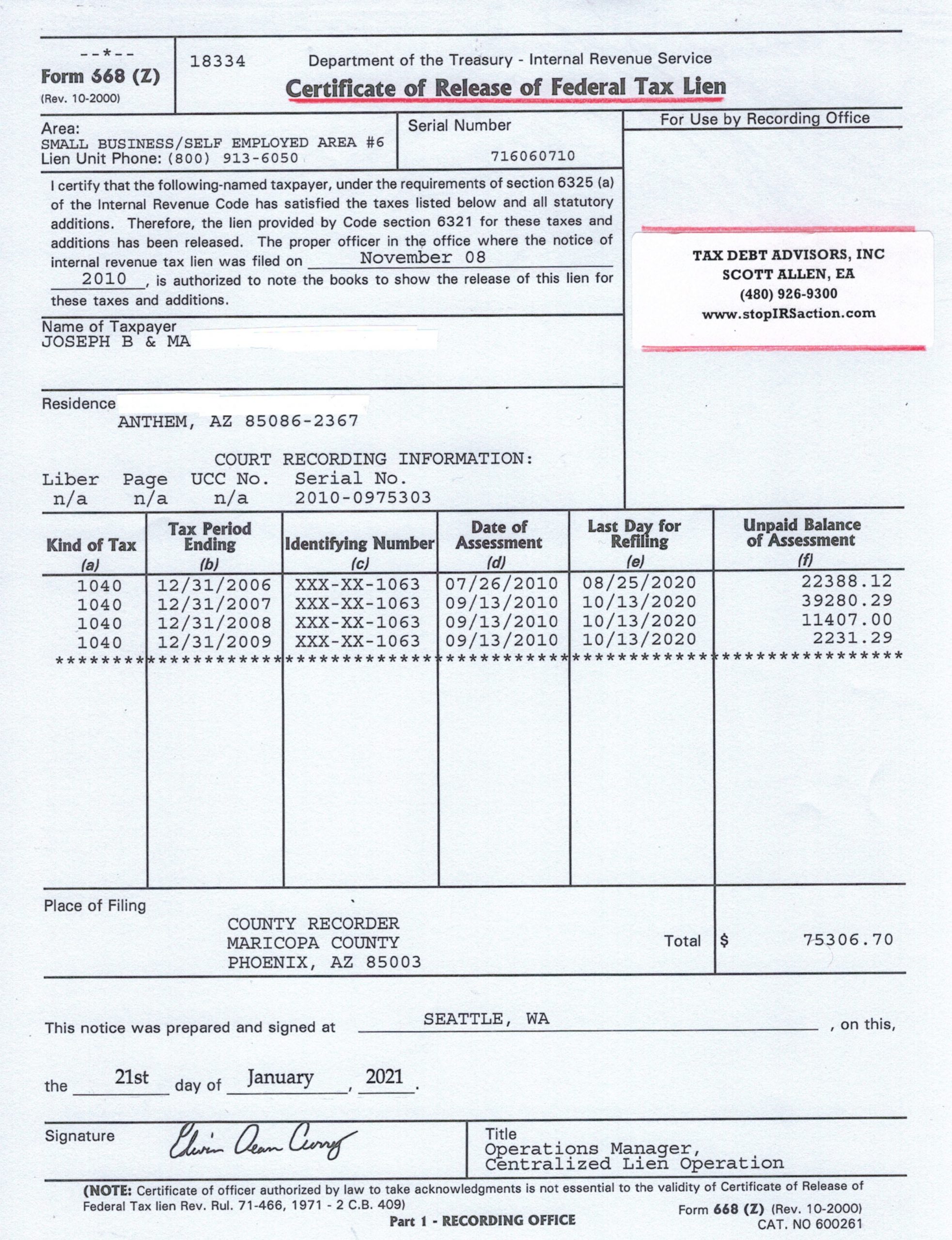

Irs Tax Lien In Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors